#Budget2017: FDI Norms May Be Eased Later This Year

Updated on February 1, 2017:

As Finance Minister Arun Jaitley tabled the Union Budget 2017-18 in the Lok Sabha, speculations were made about easing of the foreign direct investment (FDI) norms to bring down the fiscal deficit. In a move that is likely to simplify the process, Jaitley announced the abolition of Foreign Investment Promotion Board (FIPB). The FIPB used to offer single-window clearance for applications on FDI in India that is under the approval route. The board was constituted under the Prime Minister's Office at the time of economic liberalisation in 1990, and was later transferred to the Ministry of Finance.

***

There was a time when the world was undergoing economic crises and India was receiving hefty foreign investment worth $1.3 billion in 2011. Though the investment dropped in subsequent years with frequent policy changes and relaxation in FDI norms, India continued to grow on its foreign investment money.

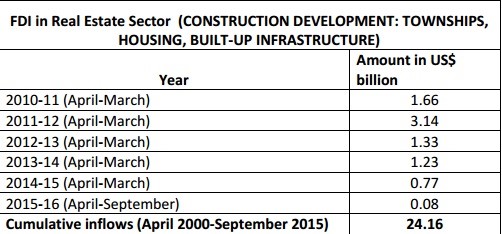

While other sectors managed to attract the FDI, investment in real estate didn't show impressive numbers. The inflow of funds continued to slow down the real estate sector. According to the Department of Industrial Policy & Promotion (DIPP), foreign investment flow in real estate and infrastructure sector is just the 9 per cent of the total investment made by foreigners in the Indian economy in period 2010-15.

While 100 per cent foreign investment was allowed in real estate, prevailed corruption, project delays and policy lag failed to attract investors.

Also read: Explaining NRI Investments In India's Real Estate

FDI in real estate in 2016

According to World Investment Report, India crossed $300 billion FDI landmark in December. Of this, 33 per cent belongs to Mauritius citizens who have taken the best benefit of double taxation avoidance treaty between India and the island state. However, the situation remained poor for real estate segment as there were no visible signs of improvement despite better environment and sentiments in the first six months of 2016.

Real estate experts are hoping for a better year ahead due to imminent policy changes. As most of the states have already notified rules under Real Estate (Regulation and Development) Bill, 2016, the implementation would definitely make the unprecedented impact. Uniform tax regime and further liberalisation in policies are other triggers that can appeal to investors.

Also read: Fed Rate Hike Just Made Indian Real Estate More Attractive For NRIs

While the construction sector was waiting for the respite, smart cities and infrastructure sector became eye candies for Asian and western economies. Very recently, Japan showed interest in adopting three cities for creating smart cities. Chinese enterprises are raising bids to develop industrial towns in India and create smooth infrastructure for their flourishing businesses. One of the recent instances is Sohna Industrial Town where premier companies are expecting to invest Rs 17,000 crore.

So far, two MoUs have been signed for smart city development. The US Trade and Development Agency (USTDA) inked a MoU for Vishakhapatnam, Allahabad and Ajmer, and the French Agency for Development signed a pact to assist Nagpur, Chandigarh and Oulgaret. However, no actual transaction of funds has taken place in past two years for smart cities mission from foreign counterparts which have raised eyebrows of many critiques who said that the ambitious smart city projects have failed to raise excitement in investors. This information was revealed by the government in reply to an RTI query.

While FICCI survey showed that a majority of the stakeholders are satisfied with government's policy for FDI, Budget 2017 might bring tax reliefs for foreign investors along with better execution plan for implementing RERA and other laws that can make changes on the ground level.