How Did The Real Estate Market Fare In 2014?

The year 2014 wasn’t too bad for the real estate sector. The slow sectoral growth might suggest a steep decline in home buying. But, the effects of the economic slowdown on the real estate market were mixed. The year 2014 saw a decline in new supplies and sales, but the government announced many policies to spur growth in the real estate sector.

Starting from the Union Budget 2014-15, where the government eased the FDI (Foreign Direct Investments) norms and made generous investments to the affordable housing segment, to the simplification of the Land Acquisition and Real Estate Regulatory Bill in the later part of the year, the new government seemed keen on reforming the real estate market.

Here are the key trends witnessed in 2014:

Fillip to `Affordable Housing’: The year 2014 witnessed an added fillip to affordable housing with the central government understanding the needs of homebuyers. Even as the government focused on `Affordable Housing’, the figures from PropTiger’s annual report for 2014 on residential real estate reflect a trend towards the same. More than 50 percent of housing sales in the year 2014 were driven by people buying houses in the range of Rs 25 lakh to Rs 50 lakh.

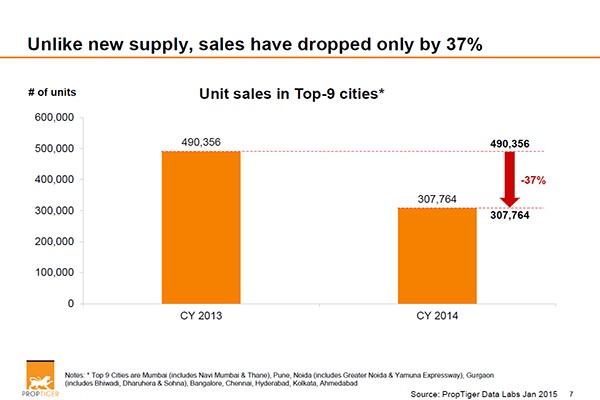

Reduction in Stock Inventory: Sales slowed down only by 37 percent. This has reduced the number of unsold inventory units over the quarters. Except Mumbai and Gurgaon, most other markets have significant portion of unsold stock in the affordable housing category. Mumbai and Noida have the most unsold inventory, 14 percent of which is more than three years old.

New supply was affordable : Driven by large concentration of demand in 25-50 lakhs budget range, large part of new supply of residential units was affordable with around 1.5 lakh units up for sale.

Development authorities such as the DDA and HUDA also launched significant supply of affordable units in 2014. The Delhi Development Authority in Delhi launched 25,034 units, followed by Yamuna Expressway Industrial Development Authority in Greater Noida with 2862 units. The City and Industrial Development Corporation of Maharashtra offered 1224 units.

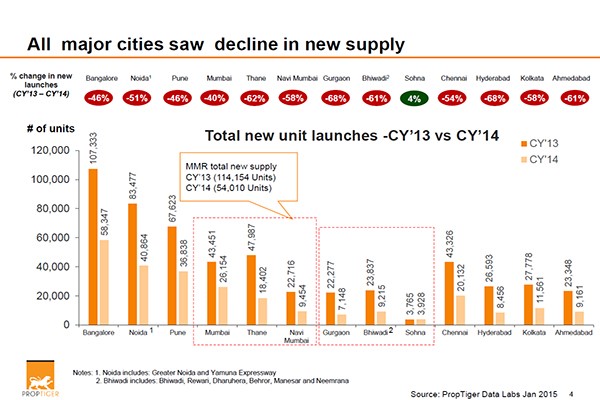

Decline in new supply: Nearly 2.6 lakh units were launched in 2014. This is a decline of 52 percent from the previous year’s figures. Apart from Sohna–Gurgaon in Delhi NCR where there was a 4 percent rise, all major micro markets like Mumbai (-40 %), Noida (-51 %), Pune (-46 %), Bangalore (-46 %), Chennai (-54 %), Kolkata (-58 %) and Ahmedabad (-61 %) witnessed a decline. The decline is attributed to economic slowdown and stocked inventories in 2013 because the sellers preferred to wait for major reforms in the next fiscal year.

Demand: Though in 2014, the market was driven by the end user, the demand in Noida-NCR was largely dominated by the investors. Hyderbad (100%), Kolkata( 92%), Ahmedabad( 84%) and Bangalore (88%) were mainly micro-markets driven by the end-users. Investment driven micromarkets were largely seen in Chennai (25%), Mumbai (23%), Pune (23%), Gurgaon(38%) and Bhiwadi (36%). Economic drivers seem to be missing in Noida, where oversupply is an issue. Lack of infrastructure and high prices, on the contrary, are blocking real estate recovery in Gurgaon.

Outlook for 2015:

2015 seems to be a good year for the residential real estate market, for three different reasons:

1) Economic activity has surged and the GDP growth rate is over 5 percentage. As various corporations have announced that they will set up offices in India, it is expected that the income levels and employment opportunities will rise. The real estate market would find this favorable.

2) The market has witnessed a change, of course, with more emphasis on affordable housing. This would bridge the gap between supply and demand in the affordable housing segment and raise the liquidity in the market.

3) The crude oil prices have declined and inflation no longer hampers economic growth. So, the RBI would be more inclined to cut the interest rates. This would lower the interest rates for home loans. This will also urge potential home buyers to take the decision to buy a house.

For more insights on the property market in 2014, find our exclusive report here:https://www.proptiger.com/images/PropTiger-2014-Indian-Real-Estate-Market-Overview.pdf