How SBI's Interest Rate Cut Will Help Home Buyers

When Reserve Bank of India (RBI) Governor Raghuram Rajan announced the largest repo rate cut in his tenure, banks did not hesitate to cut interest rates. State Bank of India (SBI) was the first mortgage lender to announce an interest rate cut of 40 basis points (bps). SBI slashed the home loan interest rate , for women, from 9.70 per cent to 9.30 per cent, and that of others, from 9.75 per cent to 9.35 per cent.

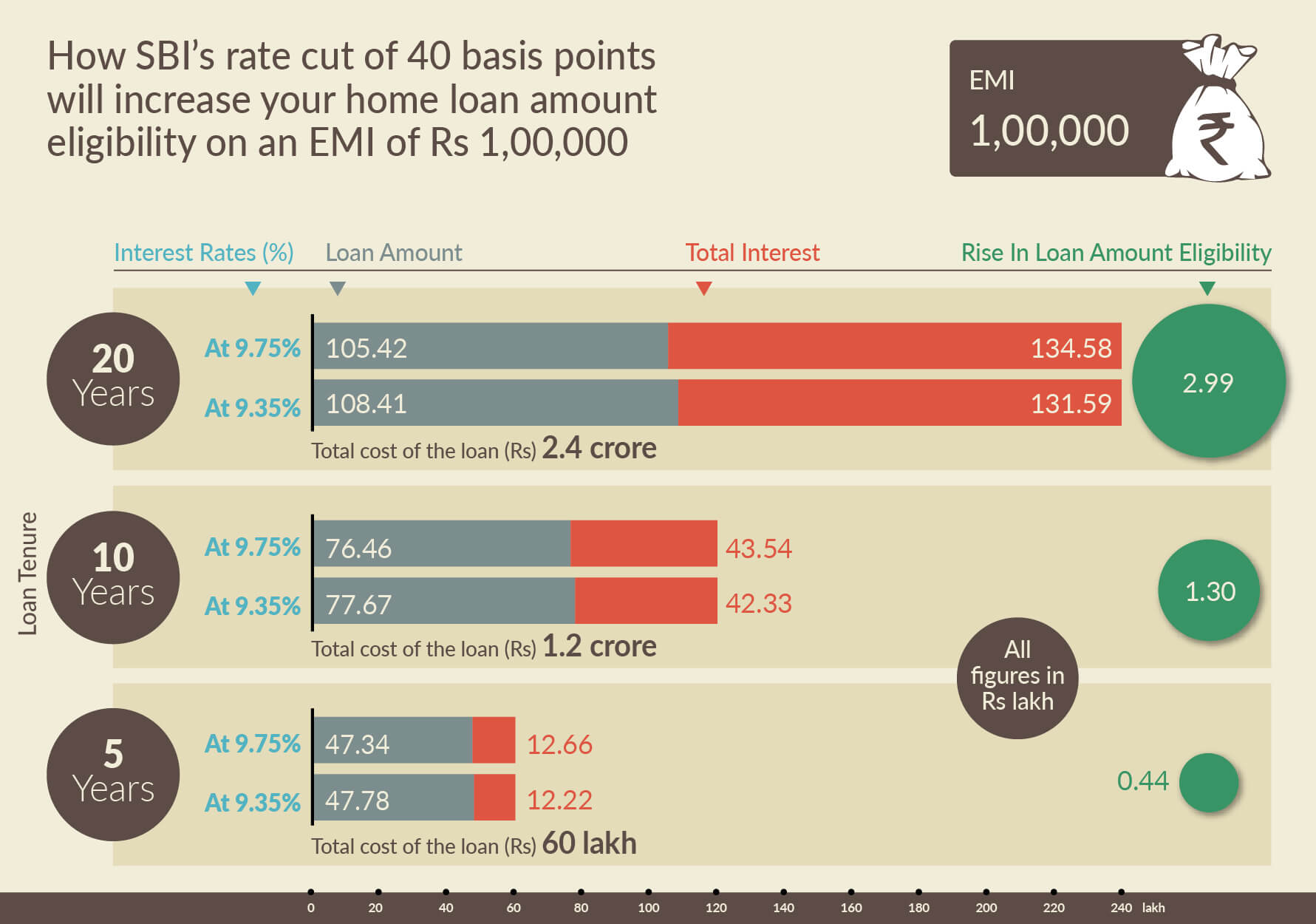

Even though the reduction in your equated monthly instalment (EMI) or tenure period is likely to be modest, with the same EMI, you will be able to buy a more expensive home. For instance, if Rs 50,000 is the most you can afford to pay as EMI, you will be eligible for a home loan of Rs 52.71 lakh, if the interest rate is 9.75 per cent, for a loan tenure period of 20 years. But, at an interest rate of 9.35 per cent, you will be eligible for a home loan of Rs 54.20 lakh. This means that over 20 years, you save nearly Rs 1.5 lakh.

Infographic By Sandeep Bhatnagar

Similarly, if Rs 1,00,000 is the most you can afford to pay as EMI, you would be eligible for a home loan of Rs 1.05 crore when the interest rate was 9.75 per cent, for a loan tenure period of 20 years. But, now, at an interest rate of 9.35 per cent, you would be eligible for a home loan of Rs 1.084 crore. Over 20 years, you save nearly Rs 3 lakh. This is nearly three per cent of the cost of your home loan. As banks have been repeatedly slashing interest rates in 2015, over your loan tenure period, the decline in interest rates may lead to substantial gains.