How To File Property Tax Online In Kolkata

In a major move to provide convenience to the owners of residential properties in the city, Kolkata municipal corporation has started accepting online payment of property tax through their portal. Property owners can file pending house tax bills, current demand bills and access letter of interest on the dues. Previously, KMC also passed an amendment to simplify the assessment and collection of property tax. With this, property owners can also calculate property tax for a residential property through self-assessment formula, known as Unit Area Assessment (UAA).

Calculating property tax in Kolkata

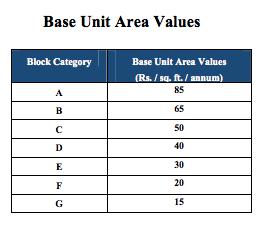

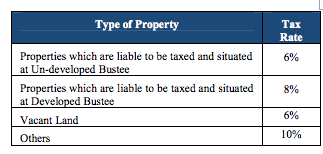

Under Unit Area Assessment system, Kolkata has been divided into 293 blocks which are further divided into seven categories (A, B, C, D, E, F and G) on the basis of market value and development. KMC has assigned annual value per sq ft also known as Base Unit Area Value (BUAV )for each category in which Category A has the highest BUAV while G has the lowest. All the bustee/slum/tenanted areas are categorised as G, irrespective of their geographical location.

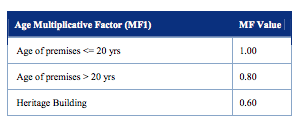

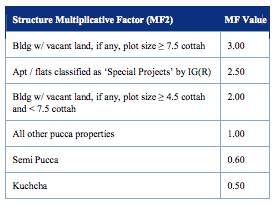

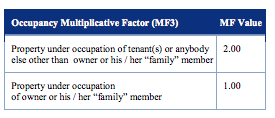

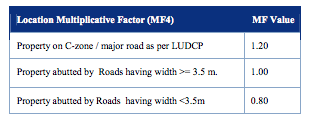

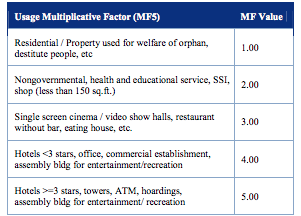

Another factor which is taken into consideration is the multiplicative factor which will be used for variations in terms of the purpose of use, age of property, its location within the block, nature of occupancy and type of structure etc. Howrah Bridge tax is an additional tax that is applicable to properties located in specific wards.

Formula-

Annual tax = BUAV x Covered Space / Land area x Location MF value x Usage MF value x Age MF value x Structure MF value x Occupancy MF value x Rate of HB tax

How to pay property tax online

- Visit www(dot)kmcgov(dot)in

- Click Online Services on left menu bar

- Choose assessment-collection from the drop-down menu

- Click Make Online Payment which will offer three options > Current PD > Fresh-Supplementary > Outstanding LOI

- You will be redirected to a new page where you have to feed assesse number, contact number and email id. The page will redirect you to the confirmation page where you can check the amount to be paid and other details.