Income Tax Rebate On an Under Construction Property: Reality or Illusion?

Significant price advantage and ease of payment has made under-construction properties a preferred choice over ready to move in properties among buyers today. But, do you know that these two stages of a real estate project have entirely contrasting tax rebate and home loan implications.

Confused? Let's elaborate the case.

The Home Loan Story

The banks offering home loans treat both ready to move in and under construction properties similarly, with the only difference being that the loan amount in the latter is disbursed in tranches (parts) on the basis of the stage of completion of construction. To ascertain the stage, banks either ask you for a certificate and supporting photograph from an architect/ civil engineer or ask their internal architect to do it.

Photo Credits: Flicke SimonCunningham

Photo Credits: Flicke SimonCunningham

Repayment

Repayment of home loans is done in the form of EMI's (Equated Monthly Installments) that starts once the loan is disbursed completely which generally coincides with completion of construction. In the meantime you pay your regular installments which is interest on the disbursed amount. This is popularly known as the pre-EMI interest.

Tax Rebate

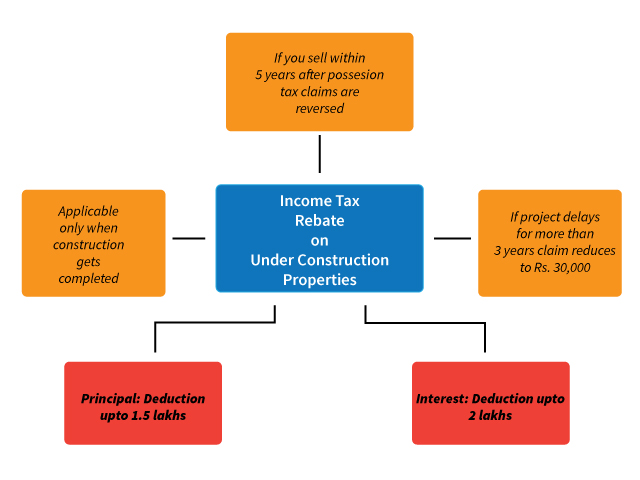

As per the provisions of Section 80C, you are allowed separate deductions on principal and interest amount, along with other eligible entities like ULIP, PF, PPF, ELSS and NSC's. In case of principal amount you can claim deduction up to Rs 1.5 lakhs (Raised from Rs 1 lakh to 1.5 lakh in Budget 2014) while in case of interest paid it is Rs 2 lakhs (Raised from Rs 1.5 lakhs to 2 lakhs in Budget 2014). The amount of stamp duty and registration fee is also eligible for tax deduction, even if you've not taken a loan to pay it off.

The benefit of rebate for both principal and interest can only be claimed from the year in which construction is completed. If you repay your principal before the construction getting completed you are not entitled to any rebate.

The “CATCH” With Under construction Properties

- In case you have already started paying your regular EMIs before completion of the project, you cannot claim any deduction till you have taken possession.

- If you sell/transfer the under construction property within five years from the end of the financial year in which construction is completed, there are several tax issues that need to be taken care of. In such cases, all deductions claimed by you earlier will be reversed and would be treated as your income for the year in which you sell your property.

- To get rebate for the interest paid before completion of construction, you can claim the accumulated interest paid up to the year before completion in five equal installments. Yes, you cannot claim it one go, the total interest paid in the span of construction of property is divided equally in the forthcoming five years.

What if your property gets delayed?

In case construction of the house is not completed within a period of three years from the end of the financial year in which the loan was taken, this claim of Rs 2 lakh (on interest) comes down to Rs 30,000.

So you can see that the tax benefits could only be availed if your builder meet the set deadlines. But, going by the normal delivery schedules of the builders (especially in NCR), a 4 year plus delivery is considered normal. In such cases home buyer loses heavily on tax rebate which will be the case in most of the projects in Delhi/NCR. Shouldn't the government change rules to take this reality in account?