The 'Serious' Home Buyer Drove Residential Market In Q4: Report

For India's real estate sector, which had been struggling for almost two years amid tepid demand, the affordable housing segment continues to be the shining spark. Of the total demand for housing units across nine top cities of India, 38 per cent was for those in the price range of Rs 25-50 lakh, shows the PropTiger DataLabs report for the fourth quarter (Q4) of 2015-16. The report further reveals that around 70 per cent of the total demand was accounted for by sub-Rs 75 lakh units.

file-page1

file-page2

file-page3

file-page4

file-page5

file-page6

file-page7

file-page8

file-page9

file-page10

file-page11

file-page12

file-page13

file-page14

file-page15

file-page16

file-page17

file-page18

file-page19

file-page20

file-page21

file-page22

file-page23

file-page24

file-page25

file-page26

file-page28

file-page29

file-page30

file-page31

If this trend is anything to go by, the consumer, especially the middle-class consumer, might again prove to be the king for the real estate market. Since this is the most sought-after segment, developers might like to offer attractive schemes and incentives to capitalise on the trend.

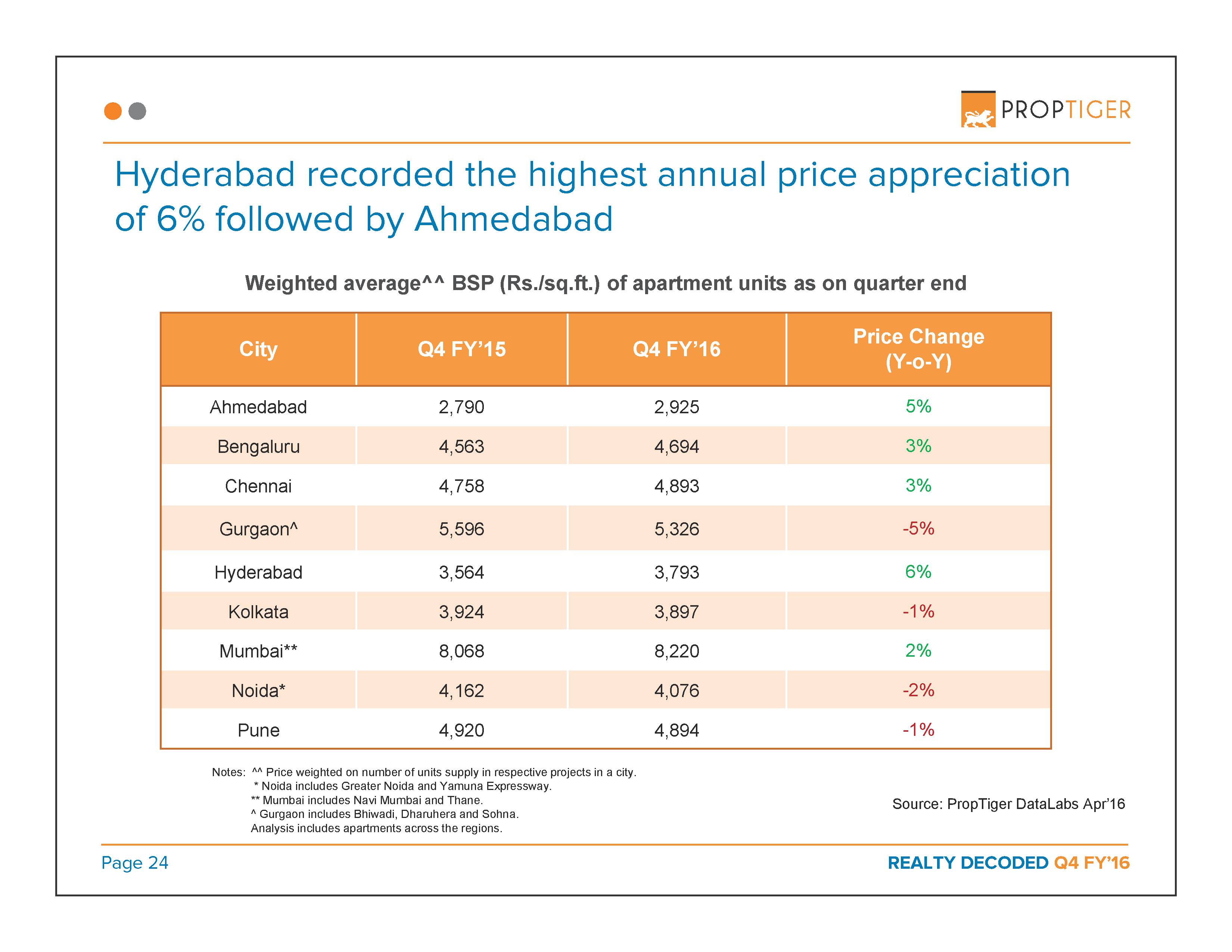

The report takes into account the housing markets in nine major cities – Ahmedabad, Bengaluru, Chennai, Gurgaon (including Bhiwadi, Dharuhera and Sohna), Hyderabad, Kolkata, Mumbai (including Navi Mumbai and Thane), Noida (including Greater Noida and Yamuna Expressway), and Pune.

The DataLabs numbers also suggest that end-users of residential units are driving the market, while real estate investors have taken a back seat for now. Given that end-users have increasingly been preferring developers with a clear intent and proven track record for delivery, developers will be further encouraged to deliver projects, cutting down on defaults.

End-use home buyers, who had been sitting on the fence for long due to increasing instances of delayed deliveries and defaults, seem to be evaluating and closing the deals, though at a slow pace. This trend is expected to get a boost in the future, especially with passage of the Real Estate (Regulation & Development) Bill, 2016. The legislation, which aims to bring transparency and accountability into the sector, is set to boost home buyers' confidence in the sector.

Another interesting trend that emerges from the DataLabs report is that buyers' interest in smaller homes is increasing – one-BHK and 2-BHK homes together accounted for 80 per cent of the total demand across India. The demand for 2-BHK units was over 60 per cent in Bengaluru, Chennai, Noida and Pune, and it was more than 50 per cent in Ahmedabad and Kolkata. Kolkata showed the most visible signs of revival in the affordable category, with the Rs 25-50 lakh segment accounting for about two-thirds of the demand in the city.

Asked about the trends that emerged in the January-March quarter and their likely impact on real estate prices, Anurag Jhanwar, business head (Consulting and Data Insights), PropTiger.com, says: “Over 97 per cent demand in major cities came from end-users. Given the price-sensitive behaviour of end-users, coupled with high inventory levels, the prices are expected to remain range-bound in short to medium term.”

Mumbai, one of the most expensive real estate pockets in India, was the biggest market for 1-BHK homes, primarily because of high prices for bigger units in this space-strapped city. While 40 per cent of the total demand in the city was for 1-BHK homes, Mumbai also topped among all cities in terms of demand for housing units priced more than Rs 1 crore.

Demand for luxury housing, however, saw a drop across India and accounted for only three per cent of the total housing demand in January-March 2016. In the luxury segment, Mumbai was followed closely by Gurgaon, where nine per cent of total demand was for units bigger than 4-BHK. These two cities have been prime markets for properties priced above Rs 1 crore.

About PropTiger DataLabs

DataLabs is the data analytics and insights division of PropTiger. It has over 150 members spread across the country, driven by the vision of providing exhaustive data on residential real estate in 36 top Indian cities. The team currently covers over 47,000 projects with updated information on over 50 parameters like project launches, sales, price trends, inventory, amenities, specifications and other market insights for each of such projects.

To read the full report, click here.