What Home Insurance companies Offer to Homeowners

You go on a small vacation with your friends and are looking forward to getting back to work inspired with fresh ideas and renewed energy. But you come back to smashed locks and thrashed furniture which you had purchased specially from the 1950s vintage furniture store and you notice that your TV, fridge and the savings from your locker are gone. What do you do? Who do you blame? What more could you have done? The response is, you could have insured your home.

Research done by Insurance Regulatory Development Authority of India (IRDA) shows that only 1% of Indian homeowners have bought home insurance. The benefits of having home insurance in case of damage to property are immense. In 2013, 12,276 house thefts were registered in India, according to the National Crime Records Bureau (NCRB). Safeguarding your home against structural damage and theft is just another way of ensuring security for your loved ones – including the home you have built with love.

Until now an uncommon practice among home owners in India, buying a home insurance is slowly gaining popularity, thanks to a range of options offered by insurance companies. Bajaj Allianz General Insurance, for instance, provides home security plans with covers as low as Rs 5 per day and this insures damages for a sum of up to 9 lakhs.

How do home insurance companies decide the insured area?

In most home insurance policies, the value of the area to be insured is measured according to the built up area and the prevailing property rate of the constructed area that is decided by the insurer. So, if the area of your home is approximately 1000 sq. ft. and the rate is Rs 1500 per sq. ft., you can buy a home insurance worth Rs 15, 00, 000.

Different Home Insurance Policies

|

Company |

Annual Premium (Rs) |

Duration (Yr) |

Special Conditions |

|

Tata AIG |

5,272 |

1 |

None |

|

Bajaj Allianz |

6,177 |

10 |

None |

|

ICICI Lombard |

10,360 |

10 |

Alternative accommodation not covered |

|

New India Assurance |

4,718 |

1 |

Jewelry and alternative accommodation not covered |

|

IFFCO Tokio |

8,406 |

1 |

Electronics more than five years old not covered |

Basic home insurance policies available to Indian homeowners (data from www.rupeetalk.com)

The table above exhibits the basic premiums of popular home insurance companies in India. When comparing ICICI Lombard with Tata AIG, you can see that buying home insurance for long term is more beneficial than applying for an annual policy. ICICI Lombard provides home security at the annual rate of around Rs 863 whereas for Tata AIG, it is Rs 5,272. In addition to the premiums given, each insurance company stipulates specific conditions as eligibility criteria.

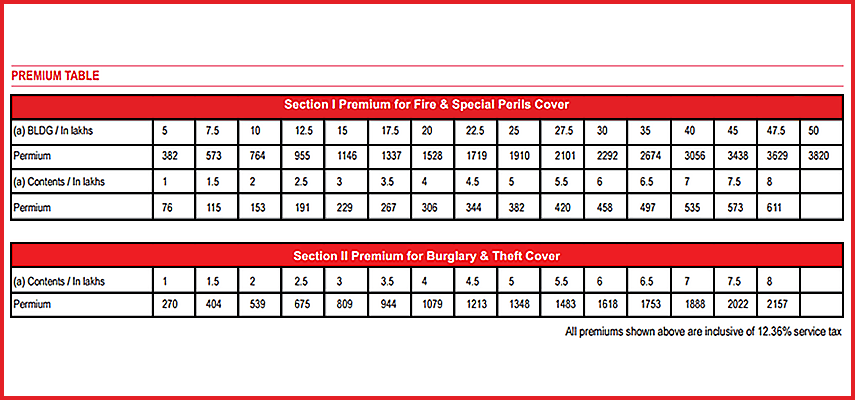

HDFC, a leading private bank, providing home finance, offers Section I Premium covering damage caused by fire, lightning, explosion, floods, storm and other incidents. Section II is for covering burglary and theft. The bank provides the basic requirements for home security. Other details are available on enquiry.

The insurance covers offered by the HDFC Premiums (Photo Credit: hdfcbank.com)

Oriental Insurance Company Ltd, a government owned insurance company, offers annual premium policies and discounts if you take a long term insurance of five to ten years. The company offers the lowest premiums in comparison to other insurance companies.

Insurance companies also offer bundled covers - for instance, Oriental Insurance provides four covers with a discount of 15% and if you choose six covers, you are offered 20% discount.

|

Absolutely Essential |

Coverage |

Asset Covered |

Premium (Rs) |

|

Damage due to natural and man-made calamities |

House valued at 50 lakh |

1,500 |

|

|

Contents valued at 10 |

255 |

||

|

Total |

1,755 |

||

|

Important |

Burglary in House |

Contents valued at 10 lakh |

1,000 |

|

Breakage |

Glass Panes, doors and shelves worth 50,000 |

250 |

|

|

Total |

1,250 |

||

|

Worth Adding |

Break down and damage |

Appliances and gadgets worth 2 lakh |

400 |

|

Theft and robbery anywhere |

Jewelry and valuable worth 1 lakh |

800 |

|

|

Baggage loss during travel |

Baggage worth 50,000 |

250 |

|

|

Death or injury due to accident |

Life cover for 5 lakh |

300 |

|

|

Total |

1,750 |

||

|

Optional Covers |

Damage due to terrorism |

House worth 50 lakh and contents worth 10 lakh |

600 |

|

Renting after damage to one house |

Rent up to 6 months |

2,500 |

|

|

Loss of rent due to damage to house |

Rent of up to 6 months |

200 |

|

|

Public liability |

Compensation of up to 1 lakh payable to third party |

40 |

|

|

Death or injury to worker |

Compensation of up to 50,000 payable to worker |

400 |

|

|

Total |

5,540 |

||

Oriental Insurance Company Premiums (Photo Credit: Economictimes.indiatimes.com)

There are many home insurance companies in the market but due to lack of awareness, few homeowners invest in it. In fact, the home insurance covers are not just for homeowners. If you stay in a rented accommodation, you could buy a cover to insure the contents of your rented accommodation and not the structure. This way, you are still partially covered if any damage occurs to the home.

Home insurance policies guarantee security and with the variety of covers in the market, you can choose your best fit to protect your valuable belongings and your home. Buying a home insurance also means that you can go on that long due holiday without worrying about thefts and damages.