Joining The Rate Cut Bandwagon: Banks That Brought It Down

After Reserve Bank of India (RBI) Governor Raghuram Rajan cut repo rate by 50 basis point (bps) on September 29, many banks followed suit and cut their own base rates, thus, bringing down the interest rates on various loans. The repo rate cut now stands at a four year low of 6.75 per cent. The total repo rate cut for the year 2015 now stands at 125 bps or 1.25 per cent.

Many banks have already started passing on the benefits of the fourth repo rate cut by Rajan, to the home buyers. Banks started cutting their own base rates soon after the announcement and others did so over the week.

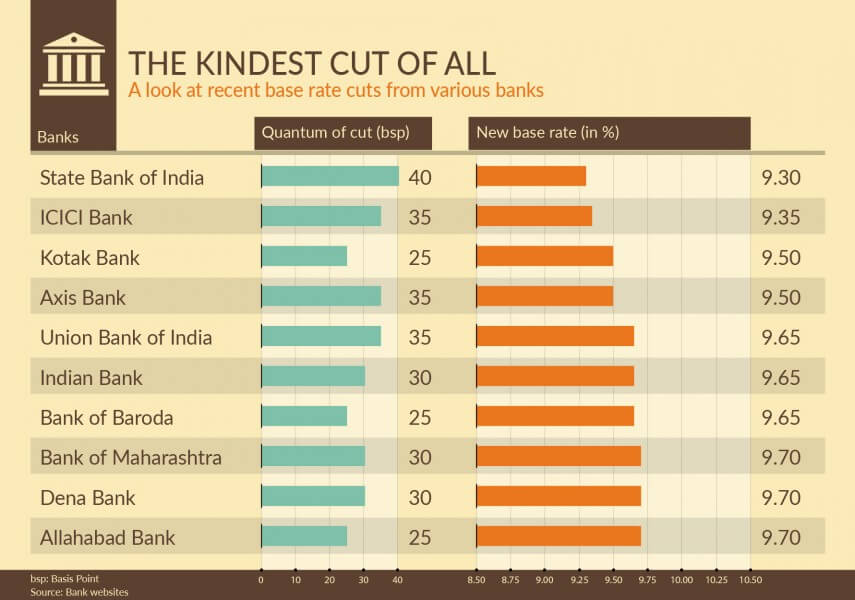

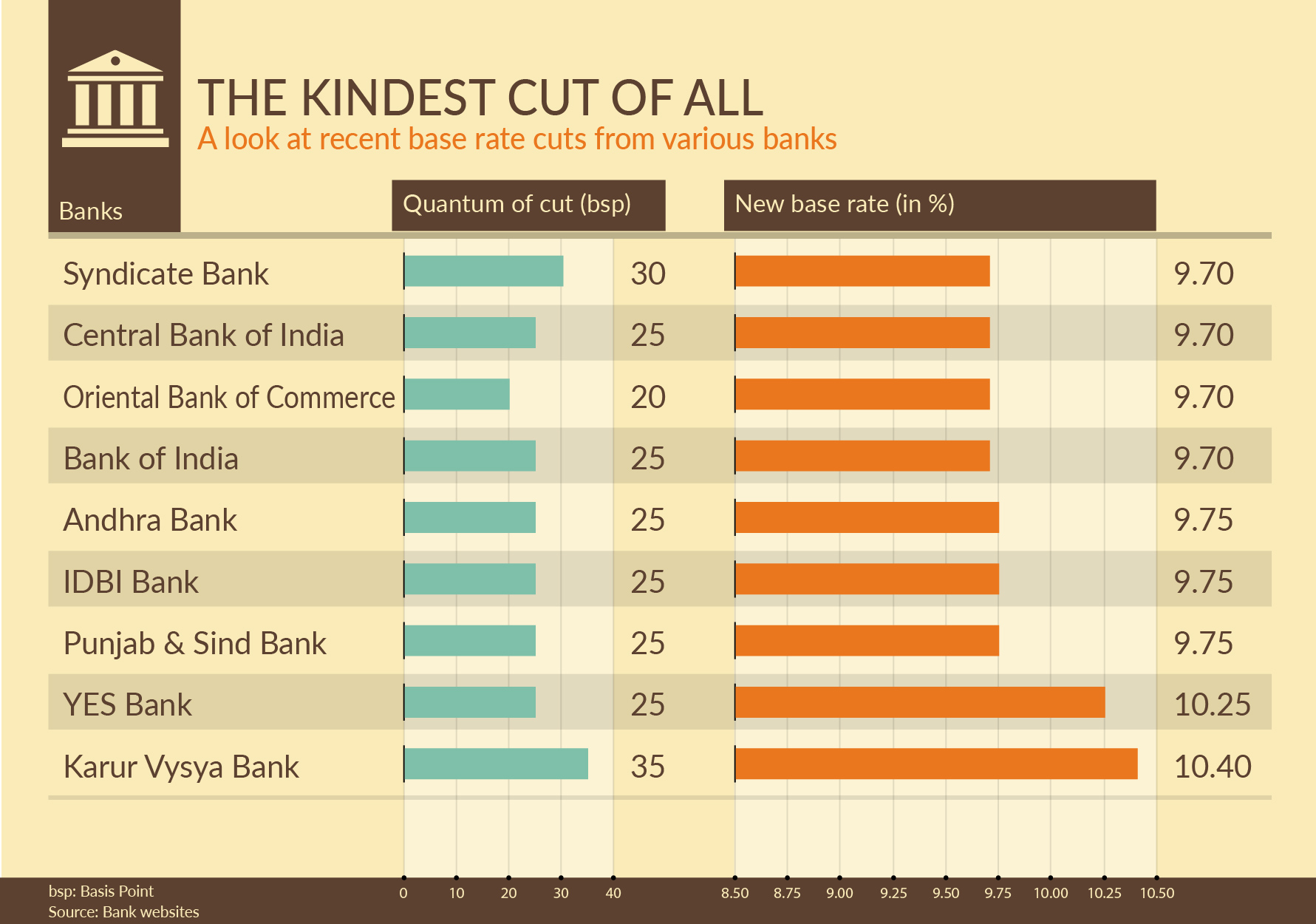

PropGuide lists banks, which offer the best interest rate, and how much did they cut.

(Infographics by Sandeep Bhatnagar)

(Infographics by Sandeep Bhatnagar)

While State Bank of India (SBI) has made the maximum cut, it does not plan to offer all its advantages to home loan seekers and existing home loan seekers. SBI cut its base rate by 40 bps, but the interest rate on home loans saw a drop of only by 15-20 bps.